Best Cryptocurrencies to Invest in Right Now (February 2025)

1. Bitcoin (BTC) – The Market Leader

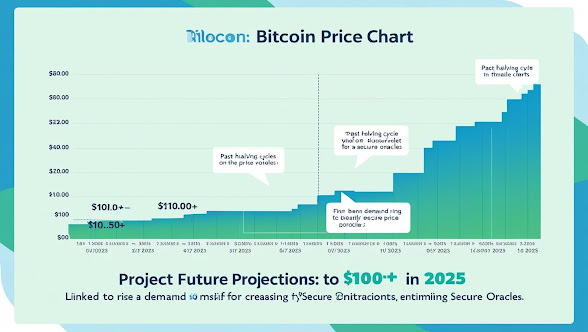

Bitcoin remains the dominant force in the cryptocurrency market. With an all-time high of $75,000, institutional adoption continues to drive its growth. The upcoming Bitcoin halving event in April 2025 is expected to further reduce supply, historically leading to price surges. BTC remains a solid long-term investment option due to its decentralized nature and increasing mainstream acceptance.

Why Invest in Bitcoin?

- Institutional investors continue accumulating BTC, with BlackRock, MicroStrategy, and Tesla expanding their holdings.

- Global economic uncertainty and inflation are driving investors towards Bitcoin as a hedge against fiat currency devaluation.

- The Lightning Network is improving Bitcoin’s transaction speed and scalability, making BTC more viable for day-to-day transactions.

- El Salvador and other countries are pushing for greater Bitcoin adoption, fueling demand.

- Bitcoin ETFs are seeing record inflows, further legitimizing BTC as an institutional-grade asset.

- Ongoing developments in Bitcoin layer-2 solutions, such as RGB and Runes Protocol, promise to enhance network functionality.

📊 Price Prediction: Analysts suggest BTC could reach $120,000+ post-halving if historical trends hold, with some extreme bullish projections pointing towards $150,000.

2. Ethereum (ETH) – Smart Contracts & DeFi Growth

Ethereum has solidified its place as the backbone of the decentralized finance (DeFi) ecosystem. With the SEC approving Ethereum ETFs, and Ethereum 2.0 fully operational, gas fees have decreased, making transactions more efficient. ETH is expected to cross $5,000 as Layer-2 solutions such as Polygon, Arbitrum, and Optimism enhance scalability and adoption.

Why Invest in Ethereum?

- The Ethereum network dominates the NFT and DeFi sectors, with billions locked in smart contracts.

- Ethereum 2.0’s Proof-of-Stake (PoS) model has improved energy efficiency and network security.

- Institutions and developers continue to prefer Ethereum for decentralized applications (dApps).

- The rise of Real-World Asset Tokenization (RWA) is being built on Ethereum, increasing its utility.

- Ethereum is leading innovations in restaking protocols and modular blockchain infrastructure, which are set to redefine blockchain efficiency.

📊 Price Prediction: ETH could potentially reach $7,000 - $8,500 by late 2025 as institutional demand rises and Layer-2 scaling becomes more effective.

3. Solana (SOL) – High-Speed Contender

Solana continues to outperform many altcoins due to its lightning-fast transaction speeds and low fees. SOL is gaining traction in NFTs, gaming, and DeFi, making it a strong contender. With Solana-based projects like Star Atlas and Helium seeing widespread adoption, SOL could breach the $250 mark in the coming months.

Why Invest in Solana?

- Capable of handling over 65,000 transactions per second (TPS), making it one of the fastest blockchains.

- Increasing adoption by NFT marketplaces like Magic Eden and gaming projects.

- Major venture capital firms continue investing in Solana’s ecosystem, enhancing long-term sustainability.

- New partnerships with Visa and Shopify are increasing real-world use cases.

- Solana is making strides in decentralized physical infrastructure networks (DePIN), further expanding its use cases beyond traditional finance.

📊 Price Prediction: SOL could reach $350 by the end of 2025, driven by DeFi, gaming, and broader institutional adoption.

4. Avalanche (AVAX) – Scaling Innovation

Avalanche is a rising star in blockchain scalability and interoperability. With its subnet technology, AVAX is gaining attention from institutional investors and DeFi applications. The platform’s speed and low fees make it an attractive alternative to Ethereum. With increasing partnerships and developments, AVAX is projected to reach $100+ in 2025.

Why Invest in Avalanche?

- Subnets allow institutions to build custom blockchain solutions, driving adoption.

- Major DeFi protocols are integrating with Avalanche due to its high throughput and low fees.

- Partnerships with Amazon Web Services (AWS) and Deloitte enhance credibility.

- Gaming and metaverse projects are increasingly being built on Avalanche.

- Avalanche’s integration with Ethereum Virtual Machine (EVM) compatibility and interchain bridging boosts its utility.

📊 Price Prediction: AVAX could see a price surge to $180+ by early 2026 if adoption continues.

5. Chainlink (LINK) – The Oracle Network

As smart contracts become more prevalent, Chainlink remains a crucial player by providing real-world data to blockchain applications. With the growing demand for decentralized finance, insurance, and supply chain applications, LINK has strong growth potential. Analysts predict LINK could surge past $50 by mid-2025.

Why Invest in Chainlink?

- Leading provider of Decentralized Oracle Networks (DONs), critical for smart contract functionality.

- Partnerships with Swift, Google Cloud, and major financial institutions indicate mainstream adoption.

- Cross-chain interoperability allows LINK to support multiple blockchain ecosystems.

- New staking mechanisms enhance incentives for long-term holders.

- Chainlink’s advancements in verifiable randomness (VRF) and CCIP (Cross-Chain Interoperability Protocol) are solidifying its position as an essential blockchain infrastructure provider.

📊 Price Prediction: LINK could see a potential rise to $100+ in 2025 as demand for secure oracles increases.

Honorable Mentions

- Polkadot (DOT): Enhancing blockchain interoperability with parachains, growing developer activity.

- Cardano (ADA): Expanding smart contract capabilities with Hydra scaling solution.

- XRP (XRP): Strengthening cross-border payments with ongoing institutional adoption.

- Polygon (MATIC): Leading Layer-2 scaling solution with partnerships across industries.

- Aptos (APT): Gaining traction as a high-performance blockchain for Web3 applications.

- Toncoin (TON): Telegram’s blockchain network seeing increased use for payments and dApps.

- Render (RNDR): Positioned at the intersection of AI and blockchain, providing decentralized GPU computing power.

- Celestia (TIA): Pioneering modular blockchain infrastructure, gaining developer interest.

Final Thoughts

With cryptocurrency markets evolving rapidly, investors should focus on fundamental developments, adoption rates, and regulatory shifts when selecting assets. The above-listed cryptocurrencies have demonstrated strong utility, adoption, and potential for growth, making them solid investment choices in 2025. Staying informed about emerging trends like AI-driven crypto trading, CBDCs, and institutional DeFi adoption can provide an edge in navigating this dynamic market.

📢 Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.

%20%E2%80%93%20The%20Market%20Leader__Bitcoin%20remains%20the%20dominant%20force%20in%20the%20cryptocurrency%20market.%20With%20an%20all-time%20high%20of%20$75,000,%20institutional%20adoption%20continues%20to%20drive%20its%20growth.%20The%20upcoming%20Bitcoi.jpg)

Comments

Post a Comment